How is the Digital Investing tool different from a traditional investment services?

It's the perfect solution for those who are just starting to learn about investing, are looking to invest smaller amounts, or looking to try out investing.

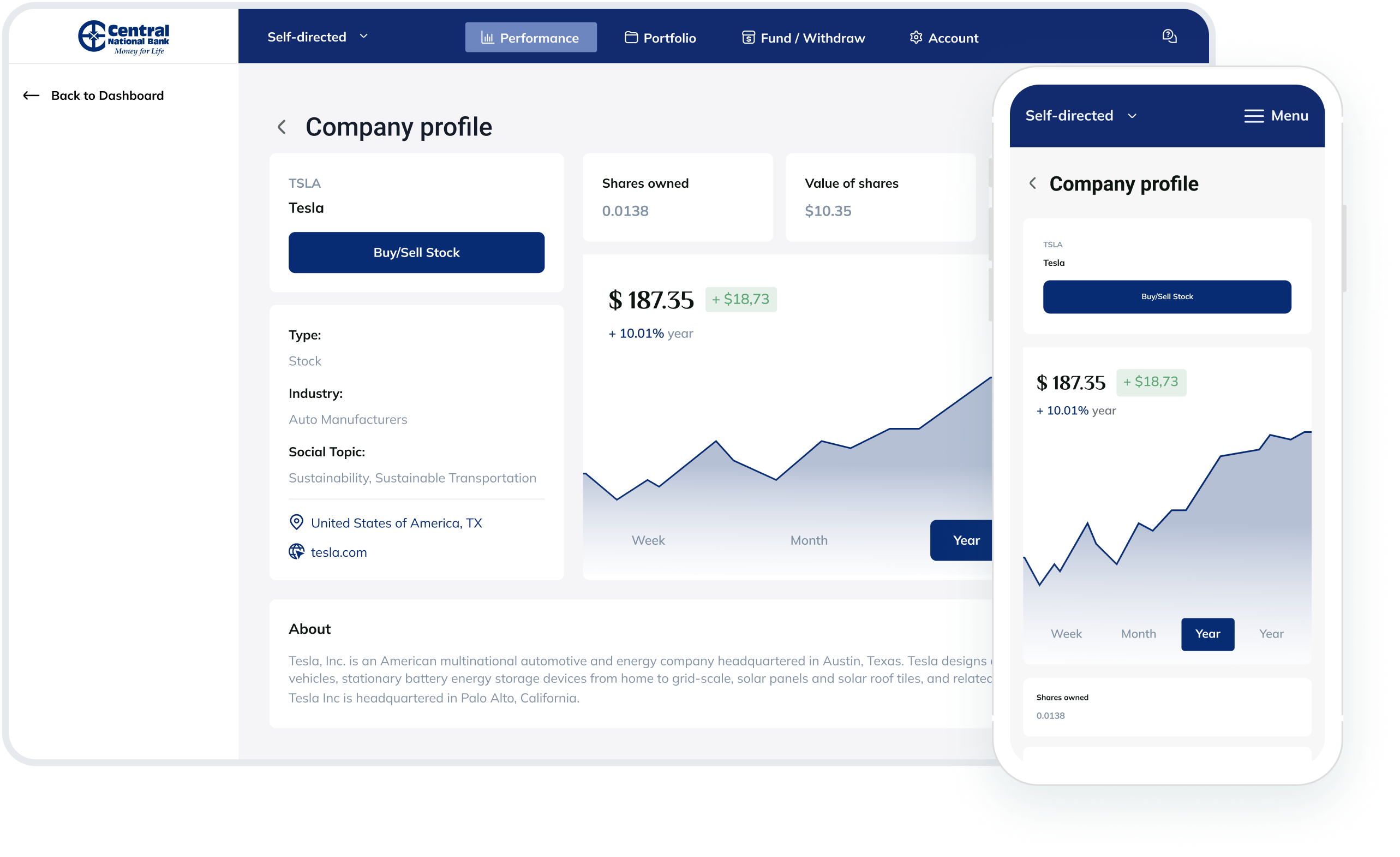

Digital Investing is an independent investing tool, meaning you manage your investments yourself.

Are investments covered by FDIC deposit insurance?

No, investments are NOT FDIC insured.

Who can open a Digital Investing account?

Customers of Central National Bank that are enrolled in online banking are eligible to invest. Must be 18 years old or older to invest. Must enroll as an individual. Digital Investing is not available to non-person entities.

What are the costs?

A Self-Directed Digital Investing portfolio is commission-free. We don't charge anything per trade, or to open or maintain your account.

For Hybrid and Pre-Built Portfolios there is an annual management fee of 0.50% based on the value of assets in the portfolio. For example, if you have $1,000 in your Digital Investing account, you will pay $5 per year. The fee is charged monthly in arrears and automatically deducted from your Digital Investing Account, so you don't need to do anything yourself to pay this management fee.

Can I always take my money out of my Digital Investing account?

Yes, we don't have a minimum holding time, and you can deposit and withdraw at any time, free of charge.

Where do I go if I have questions about my Digital Investing account?

If you have questions about your Digital Investing account you can reach out to us or email hello@eko.investments.

How do I get tax or account statements for my Digital Investing account?

If you have a tax or account statement available, you can find it by clicking 'Account' and then 'Documents and Statements'. From there, select the statement you're looking for and open or download it.

What are the risks associated with stock investing?

Stock investing involves risks such as market volatility, potential loss of capital, and company-specific risks. The value of stocks can fluctuate based on economic conditions, company performance, industry trends, and other factors.

How can I minimize the risks of stock investing?

You can minimize risks by diversifying your portfolio, investing for the long term, and having a balanced portfolio that includes a mix of different stocks and asset classes, such as bonds. The portfolios we create are by default well-diversified and balanced, which mitigate risks and optimize your investment strategy. This way, you can have a sophisticated and professionally managed portfolio, without having to be an expert yourself.

How long does it take to open a Digital Investing account?

Opening a Digital Investing account is a very quick process. The whole process can be done from your computer, tablet, or phone, and should take no longer than 5 minutes. During the onboarding, we have already pre-filled most of your personal data, which further streamlines this process. Most accounts are approved within 5 minutes. In some rare cases, additional data is required to approve your Digital Investing account, in those cases, account approval can take up to 2 business days after the additional data is provided.

How do I fund my wallet?

To fund your wallet, simply go to 'Fund/Withdraw' and select a funding amount. Next, choose which bank account you want to use for funding. This can be either an already-connected bank account or a bank account via a third-party financial institution. For funding from third-party financial institutions, we use Plaid. If you have multiple portfolios, you can also transfer funds directly between portfolios, which is instant.

What is the minimum funding amount for my wallet?

The minimal funding amount is $10.

Can I set up automatic deposits into my Digital Investing account?

Yes, you can set up automatic or recurring deposits, which will go directly into your wallet. The minimum amount for recurring deposits is just $10, and you can set it up to be weekly, bi-weekly, or monthly. At any time you can cancel or modify your recurring deposit, with a simple click of a button.

How long does it take for money to arrive in my wallet after funding?

Deposits made before 2 PM ET: These will typically arrive on the same day. Deposits made after 2 PM ET: These will generally take one business day to process.

How does Hybrid Investing work?

Hybrid Investing allows you to have a 100% personalized portfolio based on your risk appetite, investment preferences, and investment horizon. To get started, you answer a few questions to determine your investing risk tolerance and goals, and then you receive a personalized portfolio. You also have the ability to further customize your portfolio by adding or removing individual holdings. Please keep in mind that these adjustments will impact the overall risk level of your portfolio.

How do Pre-Built Portfolios work?

Pre-Built Portfolios are carefully constructed by a team of investment experts, allowing you to invest in a diversified set of assets with ease. These portfolios are managed for you, including actions such as portfolio rebalancing and tax-loss harvesting, which are done on your behalf.

What stocks and bonds are in my Pre-Built Portfolio?

The portfolio that is created for you consists of 30 stocks and bonds. All stocks in your portfolio are from the S&P 500, and all bonds are within the top 10 most traded bonds in the US. Your portfolio is always diversified and in line with your risk appetite. To learn more about your portfolio, and the individual stocks and ETFs in your portfolio, go to the 'Portfolio' section and click on your holdings.

Is my Pre-Built Portfolio actively managed for me?

Your portfolio is managed using a 'combination' approach. This means that it combines elements of both active and passive management. The active components include periodic rebalancing and tax loss harvesting to manage risk and maximize tax benefits.

Passive management refers to a 'buy-and-hold' strategy for your portfolio. A buy-and-hold approach is when you buy investments and hold onto them for a long time, instead of frequently buying and selling. The goal is to benefit from long-term market growth and minimize the impact of short-term market fluctuations.