Personal Checking

It's more than a checking account. It's money for life.

Checking Accounts with free Online Banking, Mobile Banking, Mobile Deposits, a VISA Debit Card, E-Statements, and access to LifeNOW Rewards discounts.

Open Account-

Central Premium

Open Premium

CheckingChecking Account Anywhere Banking Tools

- Online Banking

- Free Mobile Deposits

- VISA Debit Card

- E-Statement or Paper statement

- Bill Pay Included

- Digital Investing

LifeNOW Rewards1

- Cell Phone Protection

- Roadside Assistance

- ID Theft Aid

- Shop Local, Save Local with BaZing savings

- Health Savings Card

- Financial Wellness

- Buyer's Protection and Extended Warranty

- Billshark

- Pet Insurance

- Travel Accidental Death Insurance

One order of complimentary checks

Great interest on your checking balance

Two free, foreign ATM transactions per statement cycle

Sign up for It Makes ¢ents! available

- Every VISA Debit Card transaction is rounded up to the nearest dollar and the change is transferred to your savings. Plus, we match 5% of your rounded up savings total2.

About Bounce Protection

-

$9 Monthly Fee

Monthly fee is waived if the account holder has deposits totaling more than $2,500.00 with us on the day the statement is produced.

-

Central Value

Open Value

CheckingChecking Account Anywhere Banking Tools

- Online Banking

- Free Mobile Deposits

- VISA Debit Card

- E-Statement or Paper statement

- Bill Pay Included

- Digital Investing

LifeNOW Rewards1

- Cell Phone Protection

- Roadside Assistance

- ID Theft Aid

- Shop Local, Save Local with BaZing savings

- Health Savings Card

- Financial Wellness

- Buyer's Protection and Extended Warranty

- Billshark

- Pet Insurance

- Travel Accidental Death Insurance

One order of complimentary checks

Sign up for It Makes ¢ents! available

- Every VISA Debit Card transaction is rounded up to the nearest dollar and the change is transferred to your savings. Plus, we match 5% of your rounded up savings total2.

About Bounce Protection

- $7 Monthly Fee

-

Central Basic

Open Basic

CheckingChecking Account Anywhere Banking Tools

- Online Banking

- Free Mobile Deposits

- VISA Debit Card

- E-Statement or Paper statement

- Bill Pay available

- Digital Investing

Sign up for It Makes ¢ents! available

- Every VISA Debit Card transaction is rounded up to the nearest dollar and the change is transferred to your savings. Plus, we match 5% of your rounded up savings total2.

About Bounce Protection

-

$5 Monthly Fee

Monthly fee waived with account enrollment in E-Statements.

1 LifeNOW Rewards benefits are subject to restrictions, visit our LifeNOW Rewards page for more information.

2 Maximum match amount of $50 per statement cycle. You must have at least two Central National Bank deposit accounts to be eligible for It Makes ¢ents!.

Account opening subject to qualification.

All Checking accounts have a $30 minimum to open.

We understand that life doesn't always go as planned.

That's why we also have New Opportunity Checking, offering you a second chance at a first-class bank account.

New Opportunity Checking

An account with no minimum balance requirement, access to free online and mobile banking, and unlimited check writing. Designed to help you rebuild your banking history! Learn more about New Opportunity Checking or click below to open your checking account online today!

Open New Opportunity Account Learn About New Opportunity

Manage your money like it's 2026. Rely on a bank that's been here since 1884.

Our online and mobile technology keeps you in control of your finances.

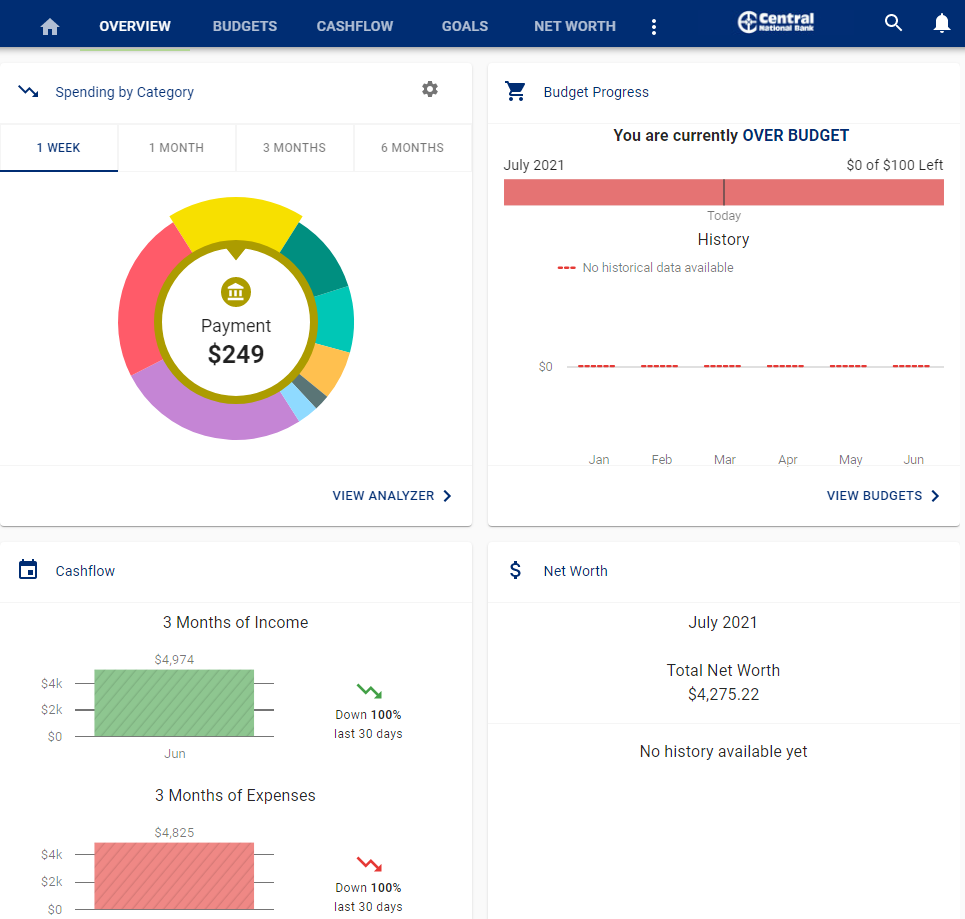

MoneyCentral

Its easier than ever to master your finances with MoneyCentral

Features

- All in one solution - Get a snapshot of all of your accounts in one place, even accounts from other institutions.

- Budgets - Track your spending and set up alerts.

- Goals - Save for that big purchase.

- Security - Your security is our priority.

MoneyCentral a complementary feature of all of our accounts.

Budget Easier With MoneyCentral

Contactless Payments

- Shop safer. Your card number is never shared with retailers keeping your data safe.

- Tap and pay with your phone to get out of the store faster.

- Shop online too. Make purchases at millions of vendors and on the web.

Smartphone App

Features

- Suspend & Unsuspend Lost or Stolen Debit Cards

- Deposit Checks

- Get Balances, Pay Bills & Make Funds Transfers

- Optional Transaction & Balance Text Message Alerts

- Find ATMs or branches near you

- E-Statements

- Fast log in with Apple TouchID on compatible Apple devices

Bill Pay

With Central Online Bill Pay, you can set up recurring payments so you never forget a bill.

Features

- One-time Payment - Create a payment that gets sent one time

- Recurring Payments - Create a weekly, bi-weekly, monthly, semi-monthly, quarterly, semi-annually or annual payment and specify when you want the payment to start and stop

- Payees - You can add, edit, or view as many payees (the entity you're sending money to) as you'd like

- Quick Payment - Set up multiple payments at once to existing payees

- Payment Types - Payments are sent by check or electronically, depending on what the payee accepts. If the payee cannot accept an electronic transaction, we'll send them a check on your behalf

- Payment History - Keep track of the payments you've made

Bill Pay is $8 per month for unlimited payments. If you have a Personal Central Value or Personal Central Premium Checking account Bill Pay is free all the time! Terms vary depending on account type.

Fraud Protection

We keep you up-to-date with the newest fraud tactics used to steal your identity as well as instructions on how to avoid them.

- When potential fraud is detected, you will receive an automatic email notification, with the option to reply with "fraud" or "no fraud."

- One minute after the email, you will receive a text alert, which also has the "fraud" or "no fraud" option.

- If there is no response received, you will then receive automatic phone calls to confirm or deny fraud. The call will also give the option of speaking to a fraud analyst.

Remember—our messages will never ask for your PIN or account number.

Visit our blog to see our recent fraud alerts.

CNBconnect© 2026 Central National Bank. All rights reserved.

Secure Page Sign-In

Ensuring the security of your personal information is important to us. When you sign in to Online Banking on our home page, your User Name and Password are secure. The moment you click the Log In button, we encrypt your user name and password using Secure Sockets Layer (SSL) technology.

Browser Security Indicators

You may notice when you are on our home page that some familiar indicators do not appear in your browser to confirm the entire page is secure. Those indicators include the small "lock" icon in the bottom right corner of the browser frame and the "s" in the Web address bar (for example, "https").

To provide the fast access to our home page, we have made signing in to Online Banking secure without making the entire page secure. You can be assured that your ID and password are secure and that only Central National Bank has access to them.

Centralnational.com is SSL-Encypted

Secure Socket Layer (SSL) technology secretly encodes (encrypts data) information that is being sent over the Internet between your computer and Central National Bank, helping to ensure that the information remains confidential.

Leaving Site

You have requested a web page that is external to the Central National Bank (CNB) web site. The operator of the site you are entering may have a privacy policy different than CNB. CNB does not endorse or monitor this web site and has no control over its content or offerings.

Continue to Site Cancel